All Categories

Featured

Table of Contents

That commonly makes them an extra inexpensive alternative for life insurance protection. Some term policies might not maintain the premium and death benefit the very same with time. You do not wish to mistakenly believe you're getting degree term protection and after that have your survivor benefit adjustment in the future. Numerous individuals obtain life insurance policy protection to aid financially safeguard their liked ones in case of their unforeseen death.

Or you may have the option to convert your existing term insurance coverage right into a permanent plan that lasts the rest of your life. Different life insurance policy policies have potential benefits and downsides, so it is very important to recognize each prior to you choose to purchase a plan. There are a number of advantages of term life insurance policy, making it a prominent selection for coverage.

As long as you pay the costs, your beneficiaries will receive the survivor benefit if you pass away while covered. That stated, it is essential to note that the majority of policies are contestable for two years which indicates insurance coverage can be rescinded on death, must a misstatement be found in the application. Plans that are not contestable typically have actually a rated survivor benefit.

Premiums are normally lower than whole life plans. With a level term policy, you can pick your insurance coverage quantity and the plan size. You're not secured right into a contract for the remainder of your life. Throughout your plan, you never ever have to fret about the costs or survivor benefit quantities altering.

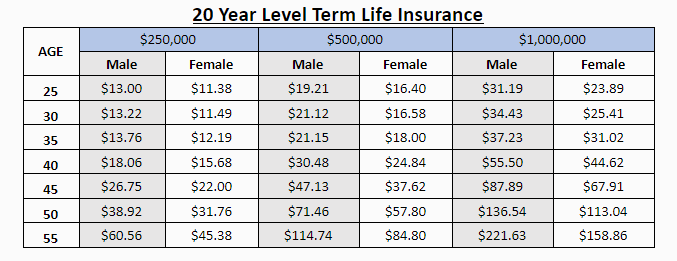

And you can't pay out your policy throughout its term, so you will not obtain any kind of monetary take advantage of your previous insurance coverage. As with other types of life insurance policy, the price of a level term policy depends upon your age, protection requirements, work, way of living and health. Usually, you'll discover extra budget friendly coverage if you're more youthful, healthier and much less high-risk to guarantee.

Affordable Which Of These Is Not An Advantage Of Term Life Insurance

Given that level term costs stay the exact same for the duration of coverage, you'll know precisely how much you'll pay each time. That can be a big aid when budgeting your expenses. Degree term protection additionally has some adaptability, enabling you to customize your plan with additional functions. These commonly come in the form of motorcyclists.

You may have to meet specific conditions and credentials for your insurance provider to enact this cyclist. On top of that, there might be a waiting duration of as much as 6 months before working. There additionally might be an age or time limitation on the insurance coverage. You can include a kid motorcyclist to your life insurance coverage plan so it likewise covers your kids.

The survivor benefit is generally smaller sized, and protection normally lasts till your kid turns 18 or 25. This biker might be a more cost-effective way to aid ensure your youngsters are covered as bikers can typically cover multiple dependents at the same time. Once your youngster ages out of this coverage, it may be possible to transform the biker right into a new policy.

The most typical kind of irreversible life insurance is entire life insurance, yet it has some key distinctions contrasted to level term insurance coverage. Below's a fundamental introduction of what to take into consideration when contrasting term vs.

Outstanding Increasing Term Life Insurance

Whole life entire lasts insurance coverage life, while term coverage lasts protection a specific periodDetails The costs for term life insurance policy are typically reduced than entire life protection.

One of the primary features of degree term insurance coverage is that your premiums and your fatality benefit do not change. You may have coverage that begins with a death advantage of $10,000, which might cover a home mortgage, and after that each year, the death benefit will reduce by a set amount or percent.

Due to this, it's usually an extra inexpensive sort of degree term protection. You may have life insurance policy via your employer, however it may not suffice life insurance policy for your requirements. The primary step when acquiring a policy is establishing just how much life insurance policy you require. Consider variables such as: Age Family members size and ages Employment status Revenue Debt Way of living Expected final expenses A life insurance policy calculator can aid establish just how much you need to begin.

After picking a plan, complete the application. For the underwriting process, you may have to offer general personal, wellness, way of living and work details. Your insurance provider will figure out if you are insurable and the threat you might present to them, which is mirrored in your premium costs. If you're authorized, authorize the documentation and pay your very first premium.

Guaranteed Does Term Life Insurance Cover Accidental Death

You may want to update your recipient info if you have actually had any kind of significant life changes, such as a marriage, birth or separation. Life insurance policy can occasionally feel challenging.

No, degree term life insurance policy doesn't have cash money value. Some life insurance policy policies have a financial investment feature that allows you to construct cash worth in time. A portion of your costs repayments is alloted and can gain passion with time, which grows tax-deferred during the life of your coverage.

These plans are frequently significantly more expensive than term protection. If you get to the end of your plan and are still alive, the coverage ends. Nevertheless, you have some choices if you still want some life insurance protection. You can: If you're 65 and your coverage has gone out, for instance, you might wish to buy a new 10-year degree term life insurance coverage policy.

Affordable Guaranteed Issue Term Life Insurance

You might be able to convert your term protection into a whole life plan that will last for the remainder of your life. Numerous kinds of level term policies are convertible. That indicates, at the end of your insurance coverage, you can convert some or all of your policy to entire life insurance coverage.

Level term life insurance policy is a policy that lasts a collection term usually in between 10 and thirty years and features a degree survivor benefit and degree costs that remain the exact same for the whole time the policy holds. This implies you'll recognize exactly just how much your settlements are and when you'll have to make them, enabling you to budget plan accordingly.

Degree term can be a great choice if you're aiming to acquire life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance policy Measure Research Study, 30% of all grownups in the U.S. need life insurance policy and don't have any type of kind of plan. Degree term life is predictable and affordable, which makes it one of the most preferred types of life insurance policy.

Latest Posts

Mutual Of Omaha Burial Insurance

Life Insurance Instant Quote Online

Compare Funeral Policies