All Categories

Featured

Table of Contents

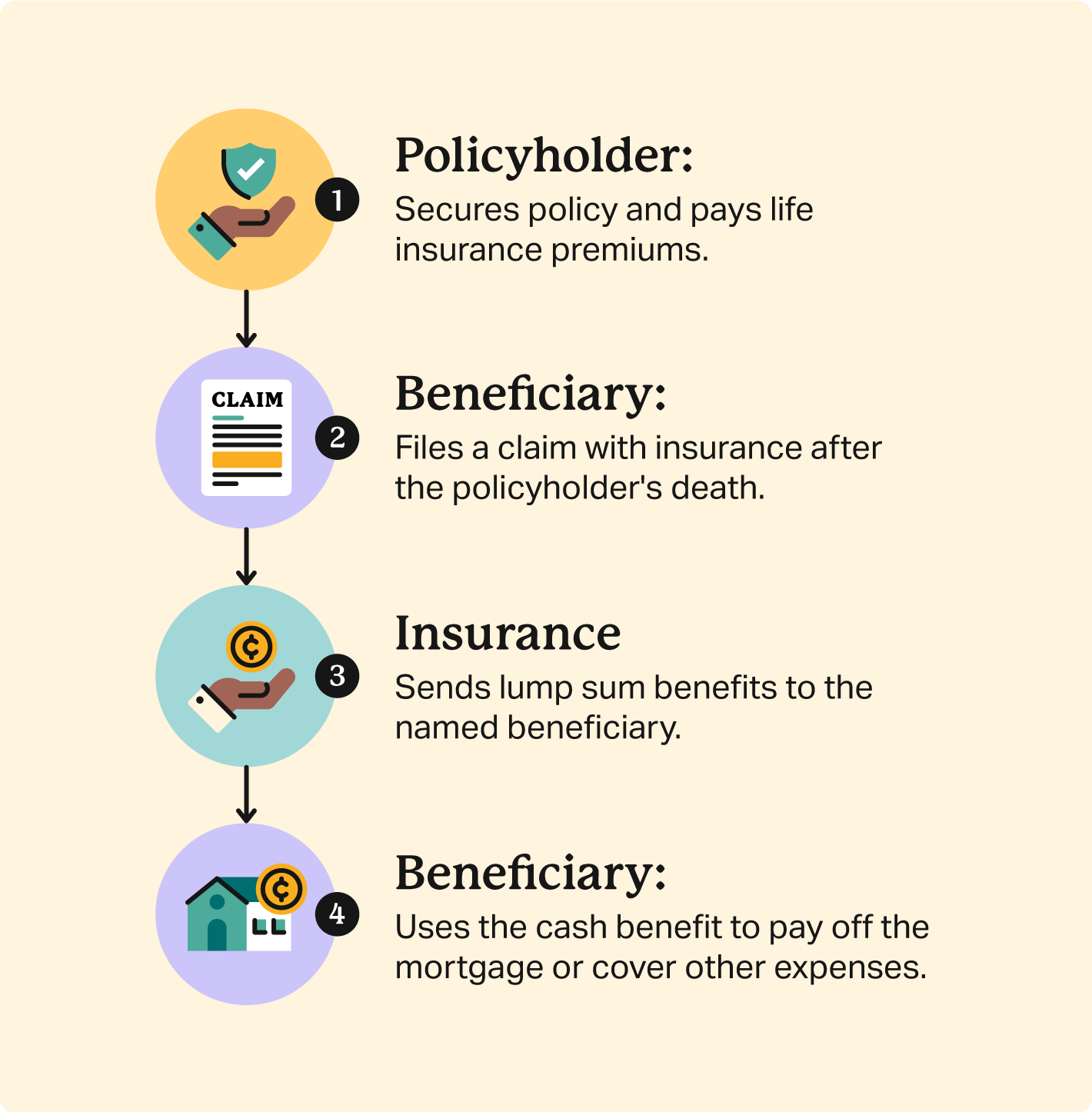

Home mortgage life insurance gives near-universal insurance coverage with minimal underwriting. There is usually no clinical examination or blood example needed and can be a valuable insurance plan choice for any type of homeowner with significant preexisting medical problems which, would avoid them from getting conventional life insurance policy. Other benefits include: With a home mortgage life insurance coverage plan in location, beneficiaries will not have to fret or wonder what might occur to the family home.

With the home mortgage paid off, the household will always have a location to live, provided they can manage the property taxes and insurance policy every year. home insurance and life insurance.

There are a couple of different kinds of home loan security insurance coverage, these consist of:: as you pay more off your home mortgage, the quantity that the policy covers reduces in line with the superior balance of your home loan. It is the most common and the most inexpensive kind of mortgage protection - aflac mortgage protection insurance.: the amount guaranteed and the costs you pay continues to be degree

This will repay the home loan and any kind of staying balance will certainly go to your estate.: if you wish to, you can include severe ailment cover to your mortgage security policy. This suggests your home mortgage will certainly be removed not only if you die, but also if you are diagnosed with a severe disease that is covered by your plan.

Mortgage Protection Insurance Explained

Additionally, if there is a balance staying after the mortgage is removed, this will certainly most likely to your estate. If you change your mortgage, there are a number of things to think about, depending upon whether you are covering up or expanding your mortgage, switching, or paying the mortgage off early. If you are covering up your mortgage, you require to make certain that your policy satisfies the brand-new worth of your mortgage.

Compare the expenses and benefits of both alternatives (do you have to have life insurance for a mortgage). It might be less costly to maintain your initial mortgage security policy and afterwards purchase a 2nd policy for the top-up quantity. Whether you are covering up your home loan or prolonging the term and require to get a new plan, you might locate that your costs is greater than the last time you secured cover

Homeowner Life Insurance

When switching your home mortgage, you can appoint your mortgage defense to the new lending institution. The costs and level of cover will certainly be the exact same as prior to if the amount you borrow, and the term of your home mortgage does not alter. If you have a plan through your lender's group scheme, your loan provider will certainly cancel the policy when you switch your mortgage.

In California, home mortgage protection insurance coverage covers the entire impressive balance of your finance. The fatality benefit is an amount equal to the balance of your mortgage at the time of your passing away.

Mortgage Protection Insurance Company

It's important to comprehend that the death advantage is given directly to your creditor, not your loved ones. This assures that the continuing to be financial obligation is paid completely and that your loved ones are spared the financial pressure. Home loan protection insurance coverage can also provide momentary protection if you come to be handicapped for an extended duration (usually 6 months to a year).

There are many advantages to getting a mortgage defense insurance coverage in California. Several of the top benefits include: Assured approval: Also if you remain in poor wellness or job in an unsafe career, there is assured authorization without medical examinations or laboratory examinations. The very same isn't real for life insurance coverage.

Disability security: As mentioned over, some MPI plans make a couple of home loan repayments if you become handicapped and can not generate the exact same revenue you were accustomed to. It is very important to keep in mind that MPI, PMI, and MIP are all various sorts of insurance coverage. Home loan security insurance coverage (MPI) is designed to repay a mortgage in situation of your death.

Very Payment Protection Insurance

You can also apply online in minutes and have your plan in position within the same day. To learn more regarding obtaining MPI insurance coverage for your home funding, call Pronto Insurance policy today! Our knowledgeable representatives are here to answer any type of concerns you might have and give further help.

It is recommended to compare quotes from different insurers to find the very best price and insurance coverage for your requirements. MPI provides a number of benefits, such as tranquility of mind and streamlined qualification processes. It has some restrictions. The survivor benefit is straight paid to the lending institution, which restricts flexibility. In addition, the advantage amount lowers in time, and MPI can be a lot more pricey than typical term life insurance policy plans.

Mortgage Credit Protection

Enter standard information about yourself and your mortgage, and we'll compare rates from various insurers. We'll also reveal you how much insurance coverage you need to secure your home mortgage.

The main advantage below is quality and self-confidence in your decision, recognizing you have a plan that fits your requirements. When you authorize the strategy, we'll manage all the documents and arrangement, making sure a smooth implementation process. The positive result is the tranquility of mind that includes knowing your household is shielded and your home is protected, no issue what takes place.

Specialist Suggestions: Assistance from seasoned specialists in insurance and annuities. Hassle-Free Arrangement: We manage all the documents and execution. Cost-efficient Solutions: Finding the ideal coverage at the most affordable possible cost.: MPI specifically covers your home loan, offering an additional layer of protection.: We work to find the most affordable remedies customized to your budget.

They can give info on the insurance coverage and advantages that you have. Typically, a healthy and balanced person can expect to pay around $50 to $100 monthly for home mortgage life insurance. It's recommended to get a tailored home mortgage life insurance quote to get an exact quote based on individual scenarios.

Table of Contents

Latest Posts

What Is Mortgage Insurance And Why Do I Need It

Exceptional Which Of These Is Not An Advantage Of Term Life Insurance

Reputable Which Of These Is Not An Advantage Of Term Life Insurance

More

Latest Posts

What Is Mortgage Insurance And Why Do I Need It

Exceptional Which Of These Is Not An Advantage Of Term Life Insurance

Reputable Which Of These Is Not An Advantage Of Term Life Insurance